unified estate tax credit 2020

Qualified Small Business Property or Farm Property Deduction. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise.

Exploring The Estate Tax Part 1 Journal Of Accountancy

If Congress under Biden.

. The previous limit for 2020 was 1158 million. For 2021 that lifetime exemption. So if someone left a 15 million estate only.

That number is used to calculate the size of the credit against estate tax. The previous limit for 2020 was 1158 million. The Estate Tax is a tax on your right to transfer property at your death.

The tax reform law doubled the BEA for tax-years 2018 through 2025. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. All people are qualified to take advantage of this tax perk from the internal revenue service irs.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158. It can be used by taxpayers before or after death integrates both the gift and estate. Unified Estate And Gift Tax Credit 2020.

Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. If youd prefer to give.

So the increase announced yesterday by the IRS means that if an estate is created ie if a person dies in 2020 there will be no estate tax imposed if the estate is worth less. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. For 2022 the lifetime gift and estate exemptions increased to 1206 million per individual and 2412 million for married couples.

The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others. This is only temporary however. The unified tax credit is designed to decrease the tax bill of the individual or estate.

If Congress does not act the tax laws revert to 56 million exemption and a top marginal rate of 55 in 2026.

Key 2021 Wealth Transfer Tax Numbers Murtha Cullina Jdsupra

Recent Developments In Estate Planning Part 2

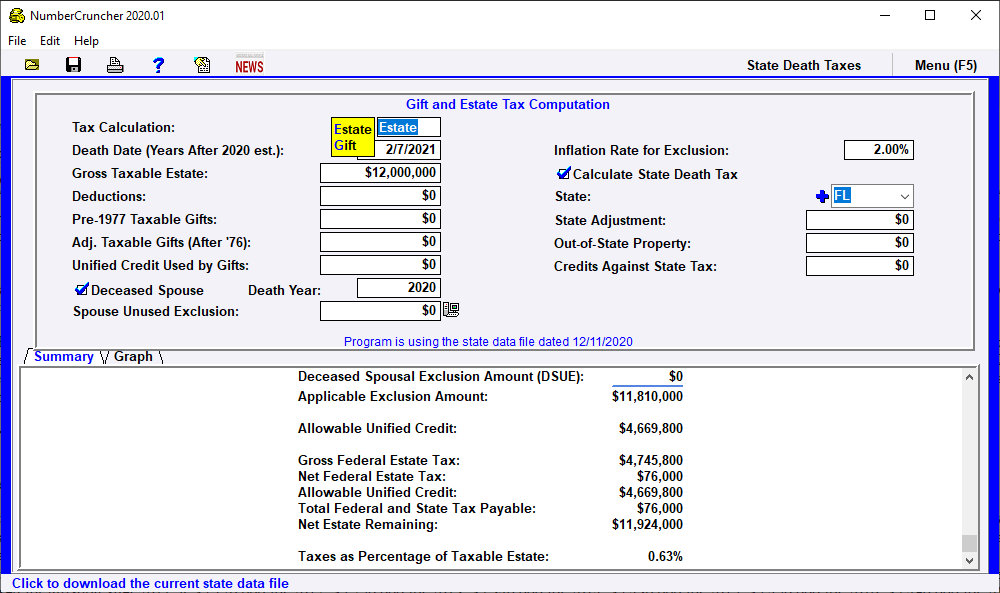

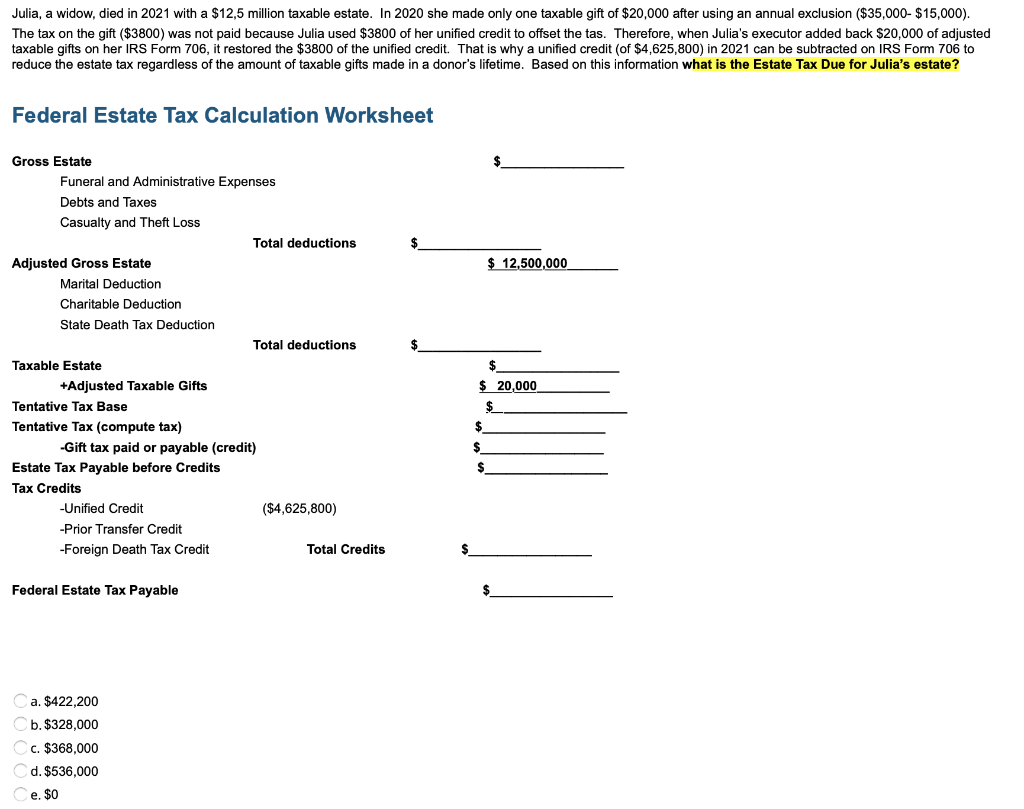

Julia A Widow Died In 2021 With A 12 5 Million Chegg Com

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Personal Planning Strategies Lexology

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Understanding How The Unified Credit Works Smartasset

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

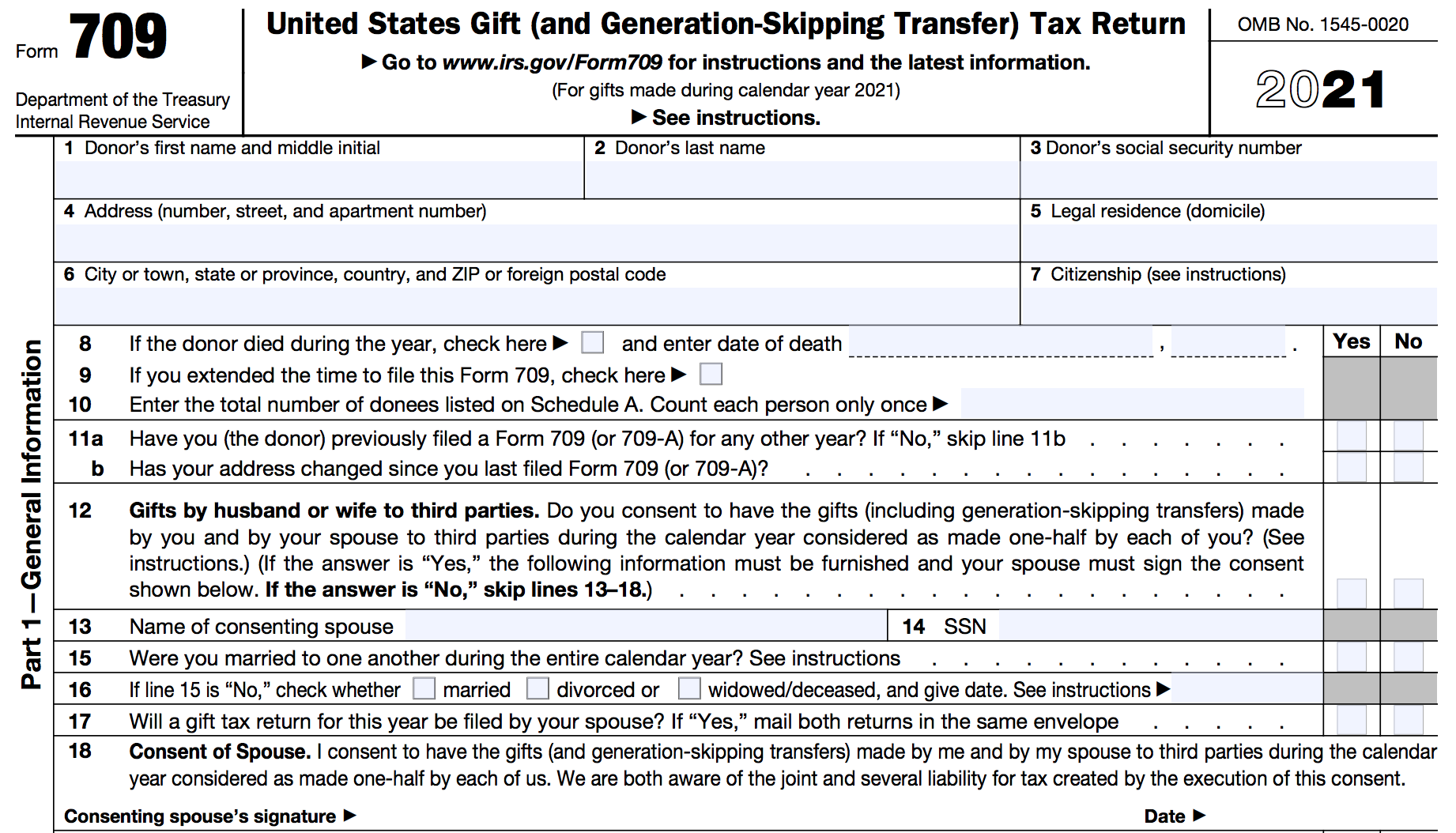

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

What Is The Unified Tax Credit For 2021

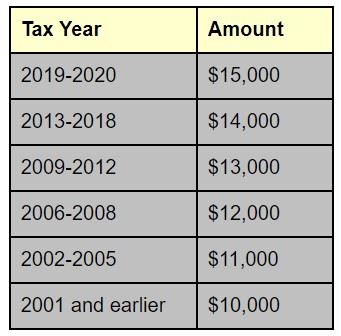

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

U S Estate Tax For Canadians Manulife Investment Management

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

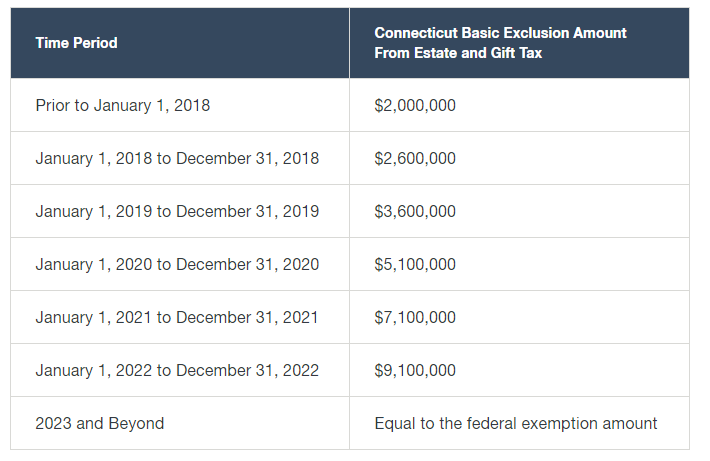

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp